An opportunity or a threat?

A critique from the perspective of religious organisations through the lense of public benefit

It was quite an innocent question really, a local charity had been thinking about trustees’ liabilities. There was a management group which looked after all of the day to day affairs of the charity, whilst the trustees held the assets, which consisted some land and buildings from which the charity conducted its affairs, and bank accounts, which were actually operated by the management team. The trustees had little to do, as trustees, with the day to day affairs and conduct of the charity. They had however woken up to the fact that should anything go wrong at the charity, they would be held responsible for it, and had in mind that the financial penalties may not be trivial.

For many years that had not been the case. There was no or little possibility of damage arising out of the activities of the charity, but things were changing. People did not have the same trust in each other as before, and there were some who, in order to indulge or facilitate illegal activity looked for easy targets, gaining confidence of the local people and acquiring places of responsibility, which could be used to cover up their lawless deeds. Others outside the charity began to look for ways in which they could criticise the charity for no other reason than they wanted to shut it down, or obtain some pecuniary advantage for themselves by claiming damages for a personal injury which they had suffered. Often the difficulty with defending such claims is that the ‘injured’ had no connection with the actual event, occasion or individual whose words or actions gave rise to the ‘injury’, the injurious action may simply have been reported to them by a third party.

In the past such claims would have been dismissed as, as they might say in law, nefarious, illegitimate or capricious, but changing views and attitudes in society, as well as the increasing propensity of those who are looking for opportunities to take offence at views with which they simply disagree, to take matters to law, has started to mean that the courts are taking seriously the claims and awarding in some case substantial damages for offence taken, when no offence was intended. It had become so bad that even comedians were disinclined to commence their stories with ‘Did you hear about the Englishman, Welshman and Scotsman?’ it having become far too dangerous to use Irishman as the second guy even many years ago.

Now before you read on, you may care to note that I might here say, and perhaps already have said, things which some would want to consider offensive, or at least suggest have an element of conspiracy theoretics about it, so let me say that I do not subscribe to conspiracy theories and anything in here that may suggest otherwise is a misconstruction or misconstrual of my meaning or alternatively the consequence of an extrapolation from what has been said to an insupportable conclusion. And for those who would want to consider something as offensive, let me add that if what I say is read correctly, and as I intended it to be read, there will be found to be no offence in it, but if it is deliberately misunderstood because I have used an ambiguous grammatical construction, placed a gerund where an adjective should sit, used a preposition to leave it dangling at the end of a sentence or caused an infinitive to be split into its inseparable parts, then let it be known that such may or may not have been deliberate upon my part, or may have been quite accidental, and where clarification of the particular grammatical device is required, then I shall be happy to receive due corrections explaining the error into which I have fallen providing it clearly explains fully all the possible misconstructions of meaning that may arise, or have arisen, as a result of the alleged gaffe, together with a reworking of the text such that its correct inoffensive meaning may be fully, perfectly and completely be understood by the newly proposed text. With that in mind, let on the reader read.

The question involved the possible conversion to a Charitable Incorporated Organisation (CIO). Now CIO is a type of corporation which is regulated by the Charity Commission. This document is not the place to discuss the types of CIO available nor the manner of their incorporation. Information may be found on the Charity Commission website to address these issues and to help you to understand which type of CIO is most suitable for the purpose that you have in mind. CIO Practice Guide 14a is a good place to start if you have questions about this. The writer will also be happy to take questions from you.

A significant advantage of a CIO over a company incorporated under the Companies Acts, is that it is not regulated by Companies House. As a consequence there is a reduced administrative burden for charities which operate through a corporate structure to be a CIO than for example a company limited in any other way, eg as is often the case, by guarantee. A company limited by guarantee is registered under the Companies Acts, and if a charity also, is required to make annual returns etc to both Companies House and the Charity Commission. For many larger charities this is not a significant burden, as they will have professional staff to deal with these matters, but for many smaller or local charities, we may have amateur trustees who may not have ready access, or only expensive access, to the necessary professional skills. Incorporation as a CIO is an advantage to them.

A CIO has advantages also for charities that do not operate through corporate structures, but as unincorporated associations or as trusts. Most of these charities are, and in due time, all of them shall be, registered with the Charity Commission and must make annual returns etc to them. None of the objects of such organisations must change, apart from one particular group of organisations recognised as charitable to which I shall revert later, nor, in general terms at least, their governance. The chief advantage for the unincorporated charity is that incorporation as a CIO gives the trustees, governors, managers, or whatever else the charity trustees might call themselves, the financial protection of limited liability.

Whilst unincorporated trustees can protect themselves from financial liability to some extent by insurance, this may not be such good protection as that afforded by a limited liability company (a CIO or a company limited by guarantee), additionally trustee insurance may be more expensive for the unincorporated charity than the incorporated, which puts a greater pressure on the limited resources of the charity which are used to support its work.

The introduction of the new incorporated organisation, the CIO, was welcomed by the charity sector for providing the possibility of both a simplification of their regulatory obligations and financial protection to trustees in an increasingly litigious environment. However, it is not a suitable vehicle for all charities.

Some sub-sectors of the charity sector had objects, some of them very long standing – the writer is aware of charities whose objects and structures have remained unchanged for upwards of 100 years – which are incompatible with the requirements of the CIO. How can this be? you may well ask.

Well to understand that we have to look briefly at the history of charitable causes. Whilst the list in the preamble to the Statues of Elizabeth I did not form part of the law, the contents of that list have for four hundred years informed the law so that by the twentieth century it could be said that a charity is a organisation set up for one or more of the following purposes:

- The relief of poverty

- The advancement of education

- The advancement of religion or

- Any other purpose beneficial to the community.

These categories did not however provide a definition of what a charity is, they merely provided guidance to those who needed to assess whether a particular organisation was a charity or not. It was not until early in the twenty-first century that a definition was brought into law. In the Charities Act 2006 the original list of ten specific things, which had become a short list of four characteristics at least one of which should be found in a charity, became a new list of thirteen:

- the prevention or relief of poverty;

- the advancement of education;

- the advancement of religion;

- the advancement of health or the saving of lives;

- the advancement of citizenship or community development;

- the advancement of the arts, culture, heritage or science;

- the advancement of amateur sport;

- the advancement of human rights, conflict resolution or reconciliation or the promotion of religious or racial harmony or equality and diversity;

- the advancement of environmental protection or improvement;

- the relief of those in need because of youth, age, ill-health, disability, financial hardship or other disadvantage;

- the advancement of animal welfare;

- the promotion of the efficiency of the armed forces of the Crown or of the efficiency of the police, fire and rescue services or ambulance services;

- any other purpose already recognised in law as charitable, along with other purposes analogous to, or within the spirit of, other purposes that are recognised as charitable.

It is a new age, calling for new things. One could argue that the nine new items inserted into the 19th century list between the third and the fourth are all included in the fourth item of the 19th century list. What then was the point? Well, one could point to the greater and greater specificity introduced into the law in during the twentieth century. Perhaps one only need ask: in law how many different ways can you kill a man? Do we really need more than two, murder and manslaughter? But we do not like the law to tell us what we can and cannot do, so we multiply laws as people invent ways around the ones that are already there. Is this propensity in our natures the cause of the rapid expansion of Elizabeth’s list? Or is it much simpler than that? The nineteenth century short list of guidance gave far too much leeway to the courts to interpret matters, so a statutory definition was introduced to provide certainty.

As the same time however the idea of public benefit was given a much greater role in assessing whether an organisation set up for any of these purposes was a charity. There would no longer be a presumption that organisations set up for the first three, and the fourth, elements, of the nineteenth century guidance conferred public benefit, though there was no suggestion that those who had already been recognised as charitable under those heads would lose their status, it would become necessary to demonstrate a continuing public benefit in the activities of the organisation. This is why organisations in their report will in describing their activities say something to the effect that ‘the trustees … believe the charity satisfies the public benefit test’.

Public benefit has always been at the heart of what is charitable, but there had been a presumption that particular types of activity would always have a public benefit. It was of the essence of the activity, so the maintenance of the walls of a city would be a charitable activity. Nobody would have any doubt about that. Certain other activities would also be seen as essentially providing public benefit. So, religious activities notwithstanding the often hard opposition of the establishment, were seen as providing public benefit. Not all religious activities were recognised as charitable however, but not because they did not provide public benefit, but that the benefit they did provide was not susceptible of legal proof.

The new position today really is not ‘does the organisation qualify under any of the heads of the new list?’, but firstly ‘does it confer public benefit?’. If it does confer public benefit, then it may qualify under one of the specific items in the list, but if not under the final catch all, any other purpose. So why have a list at all? It helps us to think about the particular aspect of public benefit that may be provided by, and therefore what to look for in, any particular type of organisation.

Now we have to be careful when we talk about public benefit. It is a concept as slippery as quicksilver. It is not benefit to the public. You may hear some presenters turn the words around in this way, perhaps thinking it will make the idea easier to understand, but instead that clouds and misrepresents the meaning. The maintenance of the city walls is of no immediate benefit to the public. The charity whose object is for the relief of poverty in the parish of Nevernewthem in a well-to-do area of the Home Counties, may struggle to actually find any thing it can do in any particular year. Perhaps for many years in a row it provides no benefit to anyone let alone to the public. It is nevertheless established for public benefit. Things can be done for public benefit, which provide no benefit to the public. So, a statue may be placed on the harbour wall in Bristol for public benefit, but parts of the populous, perhaps even a significantly large part consider that it confers no benefit on the public at all. It is a hideous statue, much like a carbuncle on the nose of an old friend. The public do not have to agree that there is a public benefit for there to be public benefit. That there is public benefit is a matter of law not of fact. And, perhaps in the context of this article two things to note about public benefit (see Public benefit: an overview) in relation to the organisations that we are about to consider are: it has not been considered by the courts in relation to every charitable purpose and it keeps changing. We are back to where I started on this matter: the law of public benefit is like quicksilver.

We may now return to our questions about the CIO. Why would it, being a charitable company, not be suitable for all charities? The answer lies hidden in the depths of what is public benefit. As we have seen it is a legal concept, and furthermore it is an unstable concept. The Charity Commission acknowledge that it has not been tested for all charitable activities, perhaps because there has not been any need to test it as before the 2006 Act there was a presumption that it existed in certain types of activity that were considered to be charitable.

Before the 2006 Act it was the objects of an organisation that determined whether it would be charitable, whatever those objects were. If the objects determined under the then current understanding of the four headings public benefit would be presumed and the organisation would be charitable. Unless it fell under a limited number of exemptions it would have to register with the Charity Commission. So an organisation with a trust deed which sets out a number of specific objects, without calling them charitable but fell under the general heading of religious, concluding with a final statement that ‘the remainder of such moneys funds and property shall be applied for such purpose of a religious or benevolent nature as the Trustees or Trustee shall in their or his absolute and uncontrolled discretion think proper’ was considered to be a charity. But note here, that the Trustees had power to apply funds firstly to purposes of any religious nature. The deed does not require that the religious nature be charitable, and it is known that not all religious activities provide a public benefit which is susceptible to legal proof and thus they fail to qualify as charitable.

This particular organisation was established as a religious organisation not a charity. It was an accident of the understanding of what constituted public benefit at that time, and the presumption of public benefit that religious organisations provided, that it was considered to be a charity. It was not envisaged at the time, not indeed later, that any of the funds of the organisation would ever be applied for the purposes of a religious organisation that was not considered to be charitable, but the trustees had unfettered power to do so, and if the only religious organisation that could benefit because of restrictions elsewhere in the trust deed the trustees would be obliged to apply the funds that they held for that non-charitable organisation with all of the consequences, eg income tax may become due on its income, that might follow.

If such an organisation became a CIO there is the very great risk that its original purpose would be defeated. It could be prevented from applying the funds which had been provided by the benefactors for the very purpose for which they had been provided. In this particular case, presently there would be many religious organisations which would still qualify as charities to which the trustees could apply their funds, but as we have seen the law on public benefit is unstable and has not been tested in all cases. There is no certainty that what is today understood to be religious activities that provide public benefit will still be understood to provide public benefit tomorrow.

Even today there is talk of fundamental and religious extremism which gives rise to activities that clearly do not provide public benefit. The law is a blunt instrument, and it does not take much when parliamentary time is limited for law which is intended to deal with the harmful aspects of extremism to include within it provisions that harm the beneficial aspects of extremism. There are also other pressures within society for organisations to conform to a particular moral ethic, just as in authoritarian or totalitarian systems there are pressures to conform to a particular political view. These pressures place those who hold a different moral ethic at risk. These pressures also change the perception of what public benefit is, and are likely to influence the understanding of what public benefit means in relation to religious activity.

Any change in understanding of public benefit in relation to religious activity should not however require a change in the religious activity of an organisation that has been established for that purpose. The organisation should, unless its activity is overtly harmful and immoral, be allowed to continue to operate in accordance with its objects as a non-charitable organisation. The organisation does not change, but its standing in society changes.

It is this that makes the CIO such a dangerous vehicle for a religious organisation. The CIO can only engage in charitable activities. A religious organisation may become a CIO today because its activities are considered by reason of precedent to be charitable. Tomorrow the law of public benefit may be tested in relation to the activities such as that organisation undertakes and it be discovered that our understanding was incorrect. The precedent was wrong. That organisation’s activities were not charitable and have never been charitable, but it is too late to undo the past; the new understanding applies only from tomorrow. But for that organisation it is too late. It is a CIO, and must now conduct religious activities that comply with the new understanding of the law. It was never established for those new activities. It had been established for a different set of activities which are no longer considered to be charitable. It is known that the original benefactors were agnostic to the charitable status of those activities, and did not provide the endowment for a charitable purpose but for a specific religious purpose. The CIO cannot comply. The objects of the organisation have been defeated.

It is this aspect of a CIO which makes it so dangerous for churches, that is the body of people, the organisation, not the building which that organisation or body uses. Similar considerations apply to the congregations that meet in synagogues and mosques, but I am not speaking to their specific affairs or manner of organising and conducting themselves. I can make no comments at all in respect of the congregations of temples of Hindu or Buddhist leaning. Different consideration apply to the building, which I submit, do not require that it be on anything other than a simple trust for the use, not the ownership, of a religious organisation (narrowly defined of course). Churches are religious organisations first and foremost. They are not established as charitable organisations, though most of them are recognised as charities. I understand that a few congregations because of their peculiar structure are not presently recognised as charitable. That they are recognised as charities is an accident of our present understanding of the law of public benefit.

If they become CIO these churches are first and foremost charities which conduct religious activities. In today’s world the understanding of what constitutes public benefit permits churches to do what they have done for two thousand years. In tomorrow’s world there is no guarantee that those activities will be recognised as providing public benefit. The CIO will not be permitted to continue to engage in those activities. If it does there is the very real possibility that the Commissioners will dismiss the trustees and replace them with trustees who will be compliant with the public benefit requirement.

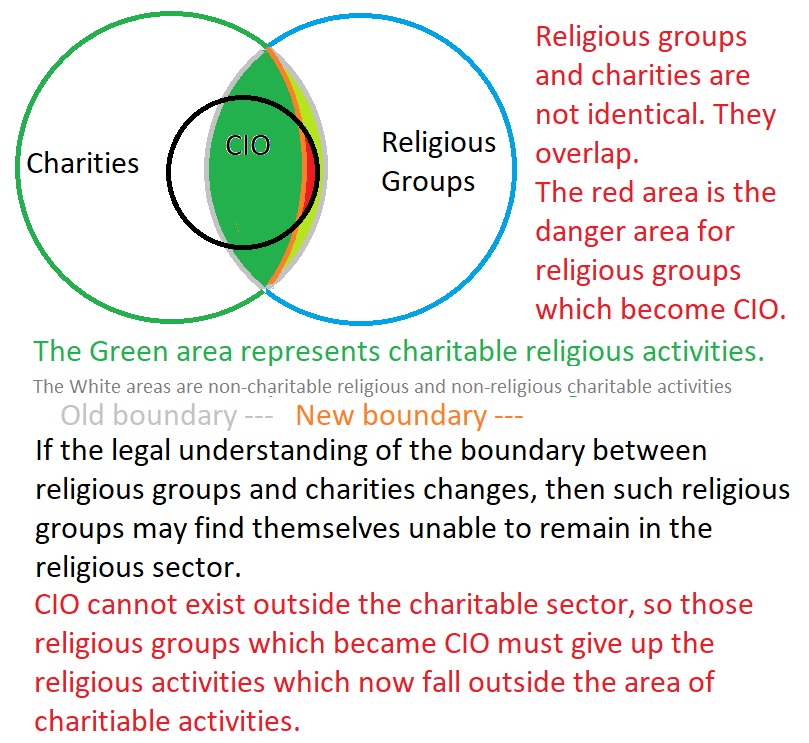

It occurred to me that a Venn type diagramme would be useful here to illustrate the relationships between religious groups, charities and CIO and what would happen if the line between charitable and non-charitable religious activities were to be drawn in a different place.

It is possible that some CIO will find that their activities are on the wrong side of the line.

I had almost suggested earlier that the CIO represents State control of a particular type of charity, but thought it better to leave that suggestion for a later point in our discussion. It is no problem for organisations that engage in other types of activity such as the relief of poverty, or the advancement of amateur sport, for these activities are firstly charitable. But for religious organisations, as CIO they are at the mercy of the current understanding of public benefit. Whether the Commissioners step in to change the trustees or not, the possibility that they can if the religious organisation continues to engage in non-charitable activities, place the CIO under the control of the Commissioners who are an arm of the State.

Religious organisations, whether they are protestant evangelical, Roman Catholic, Jewish or Islamic should not become CIO. There are other forms of incorporation, eg a company limited by guarantee, which provide financial protection to the trustees. I grant that the other approaches do not simplify your routine administration, but they do simplify what happens when what you do ceases to be recognised as charitable. As long as what you do is recognised as charitable, you will be supervised by the Charity Commission. That supervision is good for you and for the communities that you serve. If the law changes and what you have always done ceases to be charity, as a CIO you have to change what you do, but as say a company limited by guarantee you do not have to change what you do, but rather the Charity Commission, after giving you fair warning must remove your registration as a charity and cease to supervise you. The lack of registration as a charity changes your status in society. It may mean that you lose certain exemptions from taxes, but it is the taxing authorities which make those decisions not the Charity Commission.

In summary then, religious organisations are charities only because the law recognises that the activities undertaken by them are charitable. It is not the other way round. Religious organisation do not undertake religious activities because those activities are charitable. The recently introduced Charitable Incorporated Organisation (CIO) turns this on its head. It is a charity first. It can only do charitable things however broadly its objects may have been written. A religious CIO can only undertake religious activities that are charitable.

A day may come when such religious activities, and those of many other eg evangelical groups (using evangelical in the broad sense of seeking converts to a cause) may not be seen as satisfying the public benefit test. Evangelism causes conflict. Religious moral views also are often contrary to the views of the secular society. Those differences cause conflict. In the Christian tradition we know that the apostle Paul knew that well enough. If religious organisations continue to do those things that are no longer understood to satisfy the public benefit test, then they are free to continue to do them, but they lose their status as charities, and the Charity Commission ceases to have authority to regulate them (unless they continue to do other things which would satisfy the public benefit test, but then only in regard to those matters). A CIO does not have this option. It is a charity, and it cannot conduct activities that are not understood to be charitable. It never ceases to be supervised by the Charity Commission, who can step in to take control if it continues to do ‘bad’ things.

You will hear advice which is contrary to what I have written here in many quarters. Indeed there are some, who promote CIO as if they are exactly what this charity sector needs. I suggest that those who speak in this way have either not understood the risk or have underestimated the magnitude of it.

Churches, and some other groups, are religious organisations. CIO are charities which may undertake approved religious activity. Religious organisations should not become Charitable Incorporate Organisations.

The following documents which are referred to either in the article above or the comments below are included here in case they should cease to be available or their form and content be changed to reflect changes in the law after the date of publication of this article. There is no intention to infringe copyright by the copies available here, nor is there any commercial benefit in doing so. The use of the documents is for academic and educational purposes only :

8 Whilst I have included a pdf copy of these documents here, as the Stewardship document referred to is behind a registration wall it is not included. Should it cease to be available from the Stewardship website, in the first instance please ask Stewardship for a copy, but otherwise I may be able to make my copy available for inspection.

There are many helpful pages of advice or merely information on the internet for those who wish to know more about CIO, but all of those which I have inspected do not address the public benefit issue which I bring to your attention in the foregoing article. The following comments will link, and comment on, some of those pages.

https://www.gov.uk/government/publications/faith-based-charities/managing-faith-charities-as-trustees

The article addresses the question whether faith organisations should register with the Charity Commissioners and commences with the following statement:

“Places of worship such as churches, gurdwaras, mandirs, mosques, synagogues, temples and viharas are normally charities.

This is because they normally have ‘exclusively charitable purposes’. This means that everything they do is for the public benefit and fits within the legal descriptions of charitable purposes in England and Wales. These include:

advancement of religion

prevention or relief of poverty

advancement of education”

It firmly places certain faith organisations correctly in the category of charity on the basis of the existence of public benefit. It fails however to mention what public benefit is and that it is a fluid legal concept that can change over time. There is a presumption, as in so many of the other pages, that tomorrow’s law shall be today’s law.

https://fiec.org.uk/resources/should-your-church-become-a-cio

There is an important note at the foot of this page which should not be overlooked: ‘This information has been provided by solicitors working for Edward Connor Solicitors. It is designed for the purpose of knowledge sharing only and does not constitute legal advice.’

The article addresses the question ‘Should your church become a CIO?’ a much more specific question than that addressed by the Government page. Rather than an answer to that question it reads more like the answer to the two supplementary questions placed as a sub-heading to the article:

‘What are the advantages of your church becoming a Charitable Incorporated Organisation (CIO)? And how would you go about making the change?’

It answers those questions very well. I would not want to take issue with any of the reply to either of those two questions, but it completely fails to answer the questions ‘Should your church become a CIO?’

There is no presentation of any reasons for not becoming a CIO; there is no counter-argument; there is no discussion, we are left with the impression, as I suggested in the main article, that the CIO is exactly what you need.

The requirement to demonstrate public benefit is not even mentioned here, as if it is irrelevant in any of the considerations. The lack of its mentioned precludes any discussion of the impact of changes in the understanding of public benefit and how that may affect us as churches.

https://www.walkermorris.co.uk/charitable-incorporated-organisation-is-it-the-right-structure-for-you/

The article address the question: ‘Charitable Incorporated Organisation – is it the right structure for you?’

It is a broad question, and the reply given is much fairer than the replies given by the FIEC and the CC. Before answering the question, Walker Morris provide a very brief picture of the options before describing the CIO. It is a good, comprehensive, though not exhaustive, description. Only after this do they begin to provide you with some of the tools you need to answer the question for your charity. A list of advantages and a list of disadvantages are provided. There is no discussion of public benefit and what that might mean for some charities, but they are rightly not addressing that issue.

Under disadvantages however there are two helpful statements:

‘The structure is not suitable for all types of charity’

‘CIOs only come into being when registered at the Charity Commission. If registration is lost then the charity will fold (unlike companies limited by guarantee which may lose their charitable status but can continue as a company registered with Companies House)’

Both of these should be red flags for any one who has the slightest understanding of public benefit and how it is changing and may change in the future in our society, for behind both of them lies that concept. An example is provided of a type of charity for which registration may not be suitable, excepted charities. In the main these are religious charities. There are a variety of reasons why a CIO may not be suitable for them not all of which involve public benefit, and the others reasons may be more in the forefront of the mind of the writer of the article.

The second warning however is much more powerful. It turns on the loss of registration (as a charity). On what grounds would an organisation lose its registration as a charity? On the very simple ground that its objects cease to be charitable, or it begins to conduct activities that are not charitable. This change may come about in either one or both of two ways. The first is that the organisation changed its objects so that they were no longer charitable objects, but as a CIO is a charity, and must be a charity, it cannot change its objects in that way so that reason is not in view when considering a CIO.

The second reason is the one that must be under consideration, which is that the understanding of what constitutes public benefit changes in such a way that the objects and activities of the organisation cease to be charitable. The organisation does not change. It is the environment in which it exists that changes. The law changes.

Underlying what Walker Morris say in this warning is an understanding of public benefit. The article we are addressing is too short to address the issue of public benefit. If it tried to do so it would make the article far too complex for the average reader. In any event it is really only relevant for one part of the charity sector and that part of it which should be far more aware of what public benefit really means than other parts.

Finally, the reference to ‘fold’ can be many things, but here it is cease to exist, so that its assets must be distributed in accordance with its constitution, which if a CIO means to another charity. Note that is to another charity, not to another religious organisation, though the charity in receipt of the assets may also be a religious organisation, which somehow has managed to retain its charitable status even though the law has changed.

This is one of the better articles I have seen.

https://www.stewardship.org.uk/resource/charitable-incorporated-organisations-church-charities

This is an article which addresses ‘Charitable Incorporated Organisations for church charities’

I have not yet obtained a copy of the whole article. I shall update this post when I have read it.

It looks to be quite promising.

<< To form a charity, there were initially four common legal structures employed; a Trust set out in a Trust Deed, an Unincorporated Association with a Constitution, a Company limited by guarantee with Articles of Association and an Industrial and Provident Society which has a set of Rules. A fifth structure has now been made available, known as a Charitable Incorporated Organisation (CIO). Since 2 January 2013, it has been possible for the Charity Commission to register CIOs. This briefing paper looks at CIOs in England and Wales (CIOs in Scotland have been under separate legislation since April 2011). Topics covered: What is a CIO? The advantages of a CIO The disadvantages of CIOs The timetable for the registration of a CIO How to register a CIO Conversion of an existing non-company charity to a CIO Conversion of a charitable company to a CIO Conversion of an Industrial and Provident Society to a CIO Registers of charity trustees and of members Dissolution of a CIO Transferring a CIOs undertaking to another CIO >>

But the discussions I have had suggest that it too misses the public benefit point. I may have to retract that statement!

A further comment is required in connection of what happens on the winding up of a CIO that has assets.

On a winding up a charity must distribute its assets to another charity that has similar objects. Where such a charity cannot be found for example a charity for the relief of poverty in ‘Tooclosetothecy’ cannot transfer its assets to a charity for the relief of poverty in ‘Wellinlandham’, but if Tooclosetothecy has ceased to exists by reason say of being overwhelmed by the sea the Charity Commission have authority to approve a scheme which would permit such a redirection of the funds of the charity.

This restriction lies in the basic rule that you cannot give away what you do not have. So an individual may settle his own funds in trust for particular purposes which are recognised as charitable. It is within his power to do so, he is free to place a future restriction on the use of those funds. The trustees who receive the assets must deal with them in accordance with the trusts placed upon them, but they may also likewise further restrict the use of the funds when they apply them in a particular way. So if the funds are for the relief of poverty in Midlamshire, the trustees would be free to transfer the funds to a charity for the relief of poverty in Midlham, the county town of Midlamshire. In doing so they further restrict the use of the funds but it is within their power to do so. They cannot however broaden the scope of the gift by allocating funds to Westerham in Westingshire. Neither, we must note, can the Midlham City charity transfer funds to the Midlamshire charity for use elsewhere in the county, even if it had originally received the funds from the county charity. That would be without its powers.

In a similar way a religious organisation which is recognised as charitable may transfer its assets to a charity set up for similar religious purposes. On the occasion of such a transfer the use of the funds are restricted to the purposes of the new charity. Such a charity may be a CIO. But we must note that where the recipient is a CIO an additional restriction is automatically placed on the assets. Once in the hands of the CIO they can only be used for charitable purposes. The religious organisation was free to impose this additional restriction on its assets. It had the power to do so. It did not give away what it did not have.

The religious organisation could however also have used it funds for non-charitable religious purposes, providing of course that its governing document permitted such use. The CIO cannot use its assets in that way. When the CIO is wound up it cannot transfer its assets to an organisation which has power to use them in a non-charitable way – it does not have that power. If it did it would be trying to give away what it does not have. The CIO cannot even return the assets to the trust from which it received them without that same restriction being imposed on those assets. The old organisation cannot treat the assets as if nothing has happened. They are no longer held on the old trusts but a new set of much more restrictive trusts.

The rule which says you cannot give away what you do not have makes it easy to become a CIO. Organisations that are recognised as charitable may freely give their assets to a CIO, but in doing so they may unwittingly give away something else that they have but do not see that they have, the power to use their funds for works which though religious may not be charitable. Once they have lost that power it cannot be recovered. The CIO does not receive that power, it is not permitted to do so, so it cannot restore the power even if it returned its assets to the original donor.

Note that this is different than the situation where an organisation refuses to accept a gift and returns the gift to a donor. The funds never become part of the organisations assets. The funds return to the donor in exactly the state they were in when they left him. In the case of a transfer to a CIO, there is a presumption (there must be a presumption) that the transfer is accepted by the CIO: